Blog

For years, Macallan enthusiasts have faced an impossible choice: age or proof. You could enjoy the elegant 12 Year Old Sherry Oak at a gentle 80 proof, or chase the intensity of the Classic Cut at higher proof—but without an age statement. Now, it seems Macallan has finally listened.

The new Macallan 12 Year Old 110 Proof appears to bridge that frustrating gap perfectly. This release combines the maturity and refinement of a 12-year age statement with the bold, concentrated flavors that only higher proof can deliver. It's a move that feels long overdue for a distillery known for its meticulous attention to detail.

What makes this particularly exciting is the exclusive use of European oak casks seasoned with sherry wine in Jerez de la Frontera, Spain. Macallan promises rich aromas of sticky dates, cherry compote, and cinnamon, building to a palate of sultanas, stem ginger, and dark chocolate-coated espresso beans.

This isn't just another line extension—it's Macallan returning to form. The last time we saw a high-proof, sherry-cask-only Macallan with an age statement was the beloved 10 Year Cask Strength. Even the Classic Cut has been moving away from pure sherry cask maturation since 2020, while steadily dropping in proof from 57% in 2017 to just 50.5% in the 2025 release.

The 110 proof point hits that sweet spot where the whisky retains its approachability while delivering the concentrated flavors that make cask strength expressions so compelling. It's high enough to showcase the full intensity of those sherry-seasoned European oak casks without overwhelming the palate.

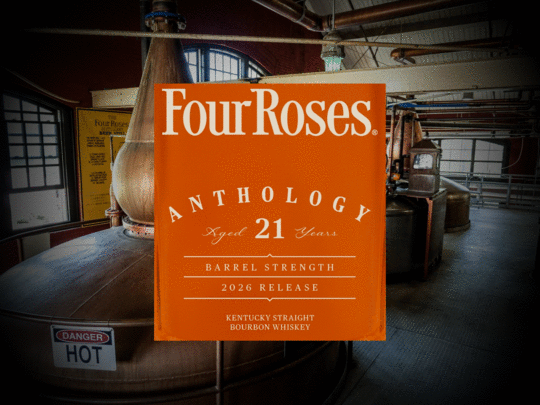

Four Roses has announced the launch of its new Anthology series, beginning with Chapter 1: Origin, a 21-year-old barrel strength Kentucky bourbon that represents the distillery's oldest single-aged expression to date.

The new series will chronicle the history and heritage of Four Roses through limited releases. Chapter 1: Origin kicks off the collection by referencing the brand's founding story, when Paul Jones Jr.'s proposal was accepted by his Southern belle, who wore a corsage of four red roses to signal her "yes."

While Four Roses has previously released blends containing older components – including a 25-year-old bourbon in their 135th Anniversary Edition and a 21-year component in their 2019 Limited Edition Small Batch – this marks the first time they've released a straight 21-year age statement. This guarantees that every drop in the bottle has aged for at least 21 years, distinguishing it from previous releases that mixed various age components.

The bourbon features Four Roses' OESO recipe, combining:

Distilled in 2001, the whiskey will be bottled at barrel strength, with an indicative 100 proof (50% ABV). The release is planned for 2026.

Production is limited to 400 bottles, making this a highly restricted release. The combination of limited quantity, record age statement, and historical significance positions this as a notable addition to Four Roses' premium offerings.

This release continues Four Roses' trend of producing aged limited editions, though it marks their most ambitious age statement for a single-aged expression. The barrel strength bottling preserves the whiskey's natural characteristics after more than two decades of maturation.

The Anthology series appears designed to explore different aspects of Four Roses' history through future releases, with Chapter 1: Origin establishing the foundation for what could become an ongoing collection of historically-themed bourbon releases.

Bardstown Bourbon Company is doubling down on their French connection with the second release in their innovative Distillery Reserve series. Following the remarkable success of their Cathedral French Oak finish—which has sold out virtually everywhere—the Kentucky distillery has unveiled their latest experiment: Bardstown Bourbon Co. Distillery Reserve, Normandie Calvados Brandy Barrel Finish.

The new label approval reveals an intriguing maturation process: straight bourbon whiskey aged 28 months in Christian Drouin Calvados barrels, then refined for an additional 4 months in toasted American barrels. The blend itself consists of 76% Indiana bourbon aged 13 years (mash bill 75/21/4) and 24% Indiana bourbon aged 12 years (also 75/21/4 mash bill). This dual-finishing approach promises to deliver layers of complexity that marry Kentucky bourbon tradition with Norman apple brandy heritage.

The choice to follow their Cathedral French Oak with a Calvados finish isn't coincidental. Bardstown appears committed to exploring France's rich barrel-aging traditions, and this latest release reinforces that theme beautifully. Where the inaugural release drew from 300-year-old French oak that helped restore Notre Dame Cathedral, this second expression taps into the artisanal world of Normandy's apple brandies.

Christian Drouin brings serious credentials to this collaboration. The family-owned Pays d'Auge distillery has been crafting vintage Calvados for three generations, earning over 230 gold medals in international spirits competitions. Their accolades include being named Best European Spirits Producer in 2013 and creating the World's Best Calvados in 2017. With 25 varieties of cider apples grown on traditional high-stem trees, Drouin represents the pinnacle of Norman distilling tradition.

The 28-month aging in Calvados barrels should impart distinctive apple and pear notes, along with the subtle spice and complexity that quality brandy barrels provide. The subsequent 4-month refinement in toasted American oak will likely integrate these French influences while adding back some classic bourbon character—vanilla, caramel, and that signature American oak sweetness.

Like its predecessor, this release embodies Bardstown's "Never Stand Still" philosophy, representing one of hundreds of experiments tucked away in their warehouses. The Distillery Reserve series continues to offer whiskey enthusiasts access to small-batch innovations that might otherwise remain hidden gems.

Following the pattern established by Cathedral French Oak, expect this Normandie Calvados finish to be available exclusively at Bardstown's gift shops in Bardstown and Louisville. Given the sellout success of the first release, bourbon hunters should move quickly when this becomes available.

The consistency of the French theme raises an interesting question: will Bardstown continue this Gallic exploration throughout the Distillery Reserve series? With France's rich tradition of barrel-aging everything from wine to cognac to armagnac, there's certainly no shortage of inspiration for future releases.

Whether this French focus was intentional from the start or simply reflects the exceptional barrels available to Bardstown's team, it's creating a compelling narrative that sets the Distillery Reserve series apart in an increasingly crowded finished whiskey market.

The latest introduction to Macallan's extensive single malt portfolio, The Timeless Collection, has brought with it an even more interesting design update across multiple Macallan collections in 2025. The Macallan Timeless Collection, informed by the Speyside Distillery's long-standing collaborative partnership with renowned artist and designer, David Carson, is the first new bottling shape since the mid 2010's, around the time the cult-status Fine Oak Collection was discontinued. This new silhouette will feature across Double Cask, Sherry Oak and the Colour Collection ranges from mid-2025 onwards.

What's changed?

The Timeless Collection reintroduces a more shapely stopper design, with accentuated contours around the bottleneck and stopper, exaggerating curvature that makes this new shape instantly recognizable and discernible when compared with its straighter, modernist predecessor. To me, this makes the bottle a touch more sophisticated and refined, reconnecting with the intention of the bottle as something we open and drink rather than collect and admire.

A sign of the times?

Several iconic brands have brought back 'classic' designs and logos in recent years, the Burberry redesign immediately springs to mind, and it seems Macallan is the latest international powerhouse to revert to a slightly more traditional shape in line with this ethos. Certainly this silhouette is closer to bottlings released during The Macallan's heyday, with the new shape purportedly a nod to the iconic roof atop The Macallan Distillery, with curves that mimic the natural landscape around its Speyside home.

We can't wait to get our hands on the latest iteration, and hope that this is a sign of things to come from Macallan, who have arguably lost there was since the turn of the decade. What do you think of the latest bottle shape? A fan or not, it's certainly got us talking here!

Just when you thought Buffalo Trace couldn't push the Eagle Rare line any further, they've gone and done something almost unthinkable: Eagle Rare 30-Year-Old Kentucky Straight Bourbon Whiskey has appeared on TTB label approvals, marking what could be one of the most audacious bourbon releases in recent memory.

The Eagle Rare family has been on quite the journey lately. What started as a humble 10-year-old has blossomed into a full premium lineup – we've seen the Double Eagle Very Rare 20 Year Old for a few years now, last year's Eagle Rare 25 (2024), and just this month, the new Eagle Rare 12 has emerged in corners of the market. But 30 years? That's entering uncharted territory for American whiskey.

The upcoming Eagle Rare 30 comes bottled at 101 proof (50.5% ABV) – a return to the higher proof that made Eagle Rare famous before the 10-year dropped to 90 proof in 2005. It's still that classic Buffalo Trace Mash Bill #1 we know and love: 71% corn, 21% rye, and 8% barley, but now with three decades of barrel interaction.

No official announcement or bottle image yet from Buffalo Trace, and both release date and pricing remain mysteries. But if recent ultra-premium bourbon trends are any indication, expect extremely limited availability and a price tag that reflects three decades of remarkably aged whiskey... This one could break the bank!

With the Trump administration announcing (and then promptly postponing) tariffs on several global importers this week, it’s an extremely uncertain time for the local U.S. whiskey and spirits economy. As the threat of a major trade war looms, sparked by the authorization of executive orders imposing 25% tariffs on liquor from Canada and Mexico, we look at the implications on the industry and how the landscape might look, for both locally produced and imported liquor, should these tariffs come into effect.

A tariff is a tax that the federal government imposes on goods or services imported from other countries. A whiskey tariff is a tax on imported whiskey (all imported liquor from the abovementioned countries is being taxed) coming into the United States, discouraging buyers from purchasing imported goods, and encouraging them to buy local.

The proposed 25% tariff on Canadian and Mexican goods covers all liquor being imported into the U.S. by these countries, the United States’ closest key trading partners. To put this in whisky terms, if a $100 bottle of Crown Royal is imported into the U.S. from Canada then that bottle will incur a 25% tariff on the product cost, payable by the importer to the U.S. government. In other words, a $100 bottle becomes a $125 bottle before it has reached the market.

Now let’s imagine in this hypothetical scenario that the importer typically sells the $100 bottle for $150. Due to the proposed 25% tariff on imported liquor, the cost increases to $125. At an increased cost, it’s unlikely that the retail price will remain at $150, instead increasing proportionately to the rising cost of goods. So the retail price increases for the end customer. In other words, what used to be a $150 bottle at the liquor store is now $175 or more, and the consumer ends up paying for it at both ends.

The new administration’s proposed tariffs on Canadian and Mexican goods were immediately met with counters in the form of same-value tariffs (25%) on U.S. whiskey and liquor products.

Counter tariffs are expected to cause considerable disruptions in the supply chains of spirits companies. Many producers are likely to implement cost-cutting measures to mitigate the financial impact, however, these strategies may only offer temporary relief and increased costs are likely to be passed on to consumers in the form of higher retail prices. “Well, I’m a bourbon drinker and don’t buy Canadian Whisky anyway!” This is a fair point, but for local businesses selling Canadian whisky or Tequila, costs will increase and end-consumers will end up fronting the bill. “So we should just buy local bourbon whiskey and liquor?” You should buy local, but let’s not forget the huge impact that counter-tariffs from Canada and Mexico could have on the U.S. whiskey industry.

Whiskey is one of the largest exported goods in the U.S., and counter-tariffs could significantly impact the local whiskey economy. If whiskey exportation becomes more costly, then local prices aren’t immune to increased prices. This is of course speculative what with the current pause in place, but given the whiskey industry saw a 5.5% decline in 2024, another barrier to growth in the form of counter-tariffs will certainly result in a retail response.

As we’ve touched on above, retaliatory tariffs and the increased costs of exporting bourbon and American whiskey from the U.S. will lead to a complex web of economic consequences that could disrupt the global spirits market. Supply chains are under threat, and with the financial implications of greater export costs, distillers and producers looking to recoup lost revenue from the cost of exportation could be forced to increase local prices as a means of regaining lost revenue. This means buying local whiskey becomes more expensive as a result of these initial taxes on imported liquor.

The Governor of Kentucky made a statement on February 4th 2025 that “harmful tariffs are putting our bourbon industry in danger”, suggesting Trump’s authorization of tariffs in Canada and Mexico has “led to retaliatory actions on Kentucky bourbon that will be costly, disruptive and harmful”, urging Kentucky’s congressional delegation to support the industry and intervene.

Similarly, the United States Distilled Spirits Council’s statement on February 1st 2025 requests a dialogue to address the potential tariffs on distilled spirits and calls for their prevention. The Council’s statement that “U.S. tariffs on imported spirits from Canada and Mexico will significantly harm all three countries and lead to a cycle of retaliatory tariffs that negatively impacts our shared industry”, a bleak insight into the potential fallout of introducing tariffs.

The authorization of liquor tariffs has thus far only triggered retaliatory measures from Canada and Mexico (excluding China), further complicating international trade dynamics. It’s a similar move to the one sanctioned in 2019 during Trump’s previous term, where he introduced scotch whisky tariffs amidst a trade dispute with the EU. It’s estimated that the scotch whisky industry took a £600 million hit during this time, with the U.S. being Scotland’s primary whisky export market.

For scotch drinkers, the tariffs imposed on Canada and Mexico are a warning sign (so stocking up now is a consideration). If a blanket 25% tariff is reintroduced and imposed on scotch whisky imports then your favorite scotch is set to become significantly more expensive. With that being said, given the UK is no longer part of the EU, it remains to be seen what sort of fallout could potentially be had on this sector of the liquor industry.

Major beverage companies are bracing for the impact of these tariffs with Diageo (Johnnie Walker, Don Julio etc.) pre-emptively withdrawing its medium-term growth targets due to the uncertainty around tariff-related fallout. According to the Financial Times, the company has estimated a potential $200 million annual profit reduction if the tariffs remain in place. Uncertain times indeed.

With so much early opposition and pushback from within the industry, it’s hard to gauge whether these tariffs will meaningfully come into effect. A 30-day pause has already been ratified, meaning we won’t have the full picture for at least another month. One thing is certain, however, if these tariffs do come into effect, the bourbon and whiskey industry globally will look quite different to the one we see today. Let’s just hope it’s not you and I footing the bill…

Buffalo Trace Distillery has announced two significant releases for 2025 with the submission of Eagle Rare 12 Year Bourbon and Weller 18 Year Bourbon labels via TTB. As if the Kentucky powerhouse’s 2024 expansions to the Taylor and Weller lineup weren’t already enough (introducing the much anticipated Taylor Barrel Proof Rye and uber-premium Weller Millennium), these two new additions to the ever-popular Eagle Rare and Weller lines bring even more variety to the core Buffalo Trace Distillery bourbon range and are sure to become hot commodities in 2025 amongst bourbon collectors and connoisseurs. While this undoubtedly diversifies the Weller and Eagle Rare portfolios, giving whiskey lovers more choices and options, what does introducing these new releases mean for the rest of the collection and will they live up to the hype?

Eagle Rare 12 Year Old Bourbon Whiskey is a 95-proof straight bourbon whiskey distilled and bottled by Buffalo Trace Distillery that represents an evolution of the standard Eagle Rare 10 Year Bourbon (90-proof). It joins the entry-level Eagle Rare 10 and becomes a middle point between this core offering and the highly limited Eagle Rare 17 Bourbon from the annual BTAC. Beyond this sit the Double Eagle Very Rare 20 Year Old Bourbon and Eagle Rare 25 Year Old Bourbon, making Eagle Rare 12 the fifth addition to this collectible and sought-after silo.

Rumours about this new bottling have already started to emerge, with suggestions that Eagle Rare 12 will be distillate that doesn’t meet the exacting standards of the elite Eagle Rare 17 and beyond, this rumour is of course mere speculation at this point (though it does make a lot of sense). Eagle Rare 12’s label suggests the tasting notes will resemble a “sweet, oaky nose, a full, complex body with subtle vanilla notes, and a long-lasting, rich finish. Reminiscent of a fine port wine, this rare whiskey is perfect for savoring neat, or over ice”.

While an additional two years in the barrel and a higher proofpoint of 95 will surely elevate the Eagle Rare profile, the implications of introducing the Eagle Rare 12 and what this means for ER10 pose an interesting conundrum… more on that below.

Weller 18 Year Old Wheat Whiskey is a 90-proof straight wheat whiskey composed of a minimum of 51% wheat in the mashbill. Weller 18 Year joins the esteemed W. L. Weller lineup, which features Weller Special, Weller Antique 107, Weller Full Proof, Weller 12 Year Old, Weller Single Barrel, Weller CYPB, William Larue Weller (BTAC), Daniel Weller and Weller Millennium.

Weller 18 Year Whiskey is the in the Weller lineup (with Weller 12 the first age stated bourbon whiskey), and unlike the abovementioned bourbons in the W. L. Weller range, is a 51% wheated whiskey rather than a wheated bourbon (51% corn). Expected to fetch a premium in the Weller vertical price spectrum, Weller 18 will likely sit somewhere in between William Larue Weller, Daniel Weller and Weller Millennium when it comes to price and accessibility. There’s no doubting the pedigree of this hotly anticipated whiskey, which is why it’s likely to become one of the rarest and most sought-after releases of 2025. While the bottle outrun on Weller 18 is sure to be extremely limited, we can assume this will have some sort of impact on the wheat reserves available to Weller’s core range, particularly the more premium releases.

It’s been well-documented over the past few years that Buffalo Trace intends to increase its production capacity and accelerate output, much to the fanfare of the bourbon community and adoring disciples of the church of Buffalo Trace. More liquor being produced means more accessible whiskey prices right? For the most part, yes, but unfortunately that’s not the full picture.

The introduction of Eagle Rare 12 at a similar age-statement to Eagle Rare 10 means that the existing distillate will likely be shared between the two iterations, which in turn means the release of Eagle Rare 12 comes at the expense of Eagle Rare 10 availability. So a new more premium core offering has the potential to increase the scarcity of its younger mainstream sibling. Not exactly a desirable outcome for bourbon fans. With Weller 18, the impact will be less noticeable on a core/mainstream level, but the pinch may be felt towards the more premium end of Weller’s spectrum with wheat distillate reserves being diluted across a greater number of products.

In any case, the announcements of Eagle Rare 12 and Weller 18 are exciting, and we’re looking forward to seeing if the juice is worth the squeeze and whether or not these bottles do end up becoming two of the best whiskey releases of 2025! Are you looking forward to these releases? Let us know your thoughts in the comments!